Global summary

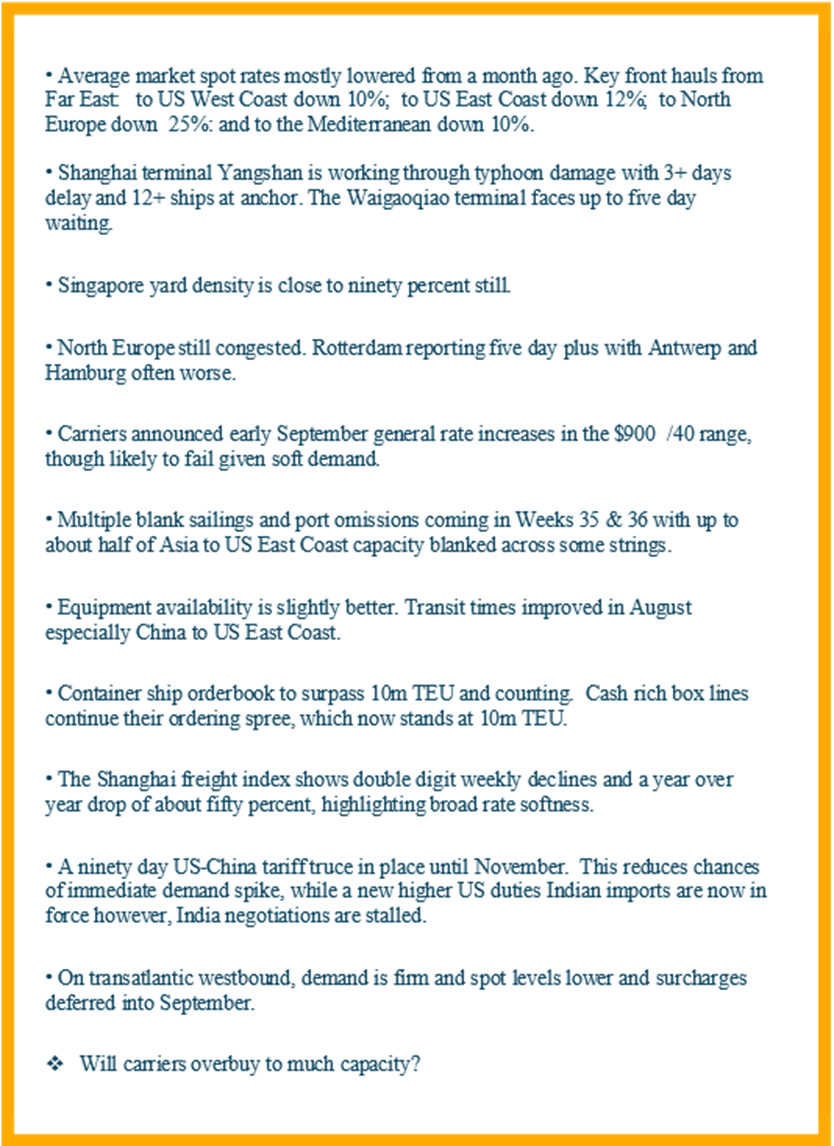

Global capacity continues to expand while demand has softened from earlier front loading. The result has been generally softening of rates for about 10-11 weeks now. Schedule reliability has improved from last year, yet it still trails pre-Covid performances. Expect a short-lived early September push from GRIs pre-Golden Week on China origin lanes, then reverting back to softer path into October as a major restocking push seems unlikely.

Weather and yard density keep several top Asian and North European hubs under pressure, adding days of delay to many routings. Transit times are lower in many key lanes.

The report indicates that many importers are barely meeting the minimum quantity commitments (MQC) of their contracts but are shifting volumes to spot markets for better deals.

At the same time, capacity continues to grow while carrier blank sailing tactics have yet to stop the price slides. Global container ship orderbooks are on track to surpass 10 million TEU. This points to a coming of overcapacity.

The US tariff situation for global supply chains, continues with significant impact to shippers. Importers are taking more cautious approaches for the coming weeks, balancing inventory levels with shifting in tariff exposure.

What changed this month?

Trade lane snapshots and near-term outlook

Asia to North America West Coast

Demand Soft to stable as earlier front-loading fades.

Supply Capacity broadly available with tactical blanks moderating lift.

Vessels and equipment Space generally open. Equipment has improved versus late July, with pockets of tightness by carrier.

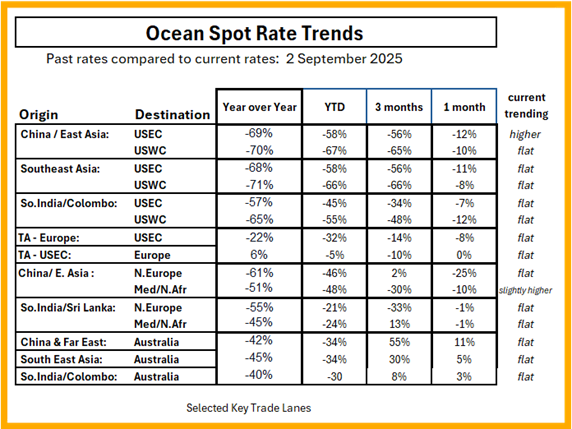

Spot rate level and direction Market average is down around 13% since end of July, continuing to drop in 2025 in spite of a late Spring spike. Year over year the ex-Shanghai index is about 60+% lower on average.

Four-to-six-week view - Possible brief early September uptick if blanks and GRIs stick, then a flat to softer bias as bookings are not expected to improve.

Asia to North America East Coast and Gulf

Demand Softer than seasonal norms after front loading, but tighter space due to capacity shifts.

Supply Multiple blanks and biweekly rotations tightening space.

Vessels and equipment Space is constrained relative to West Coast; plan two weeks ahead.

Spot rate level and direction Market average down about 12%+ since end July. Year over year 55-70% below last year’s peaks.

Four-to-six-week view - Short-term firmness if blanks hold, then a sideways to softer path unless demand returns.

Asia to North Europe

Demand Stable to slightly softer after peak.

Supply September blanks expected to trim weekly capacity by about ten percent in the first half of the month.

Vessels and equipment Origin space improved; destination congestion persists and can extend total transit.

Spot rate level and direction Spot Market average nearly 25% over the last month. Three-month trend easing. Since the start of the year rates are working down toward pre–Red Sea baselines (~50%).

Four-to-six-week view Gradual softening likely as early factory closures before Golden Week push carriers to fill ships. Continuing watch North Europe port congestion conditions.

Asia to Mediterranean

Demand Steady to easing as summer ends.

Supply South Med hubs continue to feel congestion, adding several days on some loops.

Vessels and equipment Space decent from origin; inland constraints at Genoa and other nodes can slow handoffs.

Spot rate level and direction Market average down up to 10+% in the last month. Three-month trend easing. Since the start of the year lowering rates by nearly 45% but still above pre-Red Sea rates.

Four-to-six-week view Sideways to slightly softer as carriers balance blank sailings against moderate demand.

Indian Subcontinent to North America

Demand Softening to the US East Coast following the new 25% tariff.

Supply Carriers are cutting East Coast capacity through blanks; West Coast capacity remains widely available due to oversupply on core strings.

Vessels and equipment No systemic vessel shortage.

Spot rate level and direction To the East Coast, slightly lower into September. To the West Coast, soft given ample space. Month over month lower by around 10%. Three-month even lower. Since the start of the year and year over year both easing.

Four-to-six-week view Continued soft to stable with tactical blanks on the East Coast side.

Transatlantic Westbound Europe to US East Coast

Demand Firm with stable load factors.

Supply Adequate capacity though some North Europe yards are very tight, affecting handoffs.

Vessels and equipment Ongoing equipment shortages in parts of Central and Eastern Europe.

Spot rate level and direction Rates down 8% month over month. Three month and year to date lower. Year over year lower.

Four-to-six-week view Stable with a slight firming bias where South Med congestion funnels cargo north.

Major ports with material delays

Below are top ports that meet the threshold of average three day or longer delays.

Asia

• Shanghai Ports average three days or more as storm recovery continues, with many vessels at anchor.

• Singapore yard density near ninety percent, typical waits around two days with spikes above that during bunching.

Europe

• Rotterdam five day plus berthing delays with Antwerp and Hamburg also with delays.

• Genoa major road and rail shortages causing extended handoffs.

North America

No top US or Canada gateways show sustained average three-day+ port delays, though inland equipment and chassis pinch points can appear episodically at Los Angeles Long Beach and New York New Jersey.

Mexico – Port of Manzanillo still congested.

Rail Dwell times reported at 5-7 days for Long Beach, Los Angeles, Oakland, Charleston, Savannah, Norfolk

Closing take

This market is still a game of supply control and patience. Soft bookings and a growing fleet are pulling spot rates down, while carriers counter with blanks and last-minute schedule changes. Rates continue to drop in key trade lanes. Expect carriers to push for early September rate firmness but we do not expect it to hold into October. Golden Week looks tepid. Into the new year, unless we see a stronger restock or a fresh disruption, the base case is a gradual grind toward pre–Red Sea pricing on many front hauls, interrupted by periodic capacity moves and local congestion. Expect shippers/BCOs to keep routings flexible, and to take advantage of short-term deals while they last.

Comments to me, Andy Gillespie at AndyG@WOWL.io