The Impact of New Tariffs on Global Trade

The latest U.S. tariffs are historic and profound, significantly reshaping global trade dynamics. Additional reciprocal tariffs will be layered onto existing duties, driving rates as high as 69% for some Chinese products and even higher for autos.

Meanwhile, the ocean container market faces softening demand, yet capacity remains strong despite an increase in blank sailings. This situation is putting downward pressure on rates, though carriers are resisting as Transpacific contract negotiations near their conclusion. Great pressure now on carriers by BCO/shippers & NVOs for final push for lower rates in new contracts!

Updates

Shipping Updates

- China-made vessels: Potential US fees remain, decisions pending.

- Hutchinson Ports: Sale of 43 ports to the BlackRock consortium is on hold due to an internal China review.

- Oversupply: Fleet capacity growing 33% with new builds vs. less demand.

- Geopolitical Disruptions: Ongoing geopolitical issues, such as the Red Sea crisis, have led to rerouting of vessels, increased voyage times /operating costs.

Market News

- High inventory levels in the U.S. due to front-loading of shipments.

- Weakening Demand: Soft markets with few space issues.

- Blank Sailings: 68 sailings canceled globally for April, half on Transpacific.

- April GRIs may not hold due to slack demand.

Vessel Dwell Times

- West Coast ports: Mostly operating well, except Vancouver & PRR (week+ delays).

- Rail delays: Up to one week or more at major ports.

- East Coast & Gulf ports: Minimal delays, except Halifax and Houston (almost two weeks).

Rates & Service Analysis

Global rates continue to soften in both short-term/spot rates and long-term contract rates. Long-term rates remain below short-term rate levels.

FEWB: East Asia to Europe & Mediterranean

- Supply & Demand: Demand is flat/soft while supply is strong. Red Sea/Suez remains a risk. While a restart is hoped for, most vessels continue to use the Cape of Good Hope route.

- Rates: Spot rates are still declining, now 50-55% lower than January 1 levels and 20% lower than early March. The gap between contract and spot rates remains, with Asia-North Europe contracts 5-10% lower and Asia-Med contracts about 15% lower. These gaps were much larger at the start of the year (+50%).

- Reliability: A Red Sea reopening will significantly impact speed and capacity when it happens.

Asia to U.S. (TPEB - Transpacific Eastbound)

Asia to U.S. East & Gulf Coasts

- Demand continues to weaken, with ample supply.

- Rates: Spot rates have fallen 45% since January 1, though April GRIs provided a brief increase. Spot rates are currently 15% higher than contract rates.

- Contracts: Large Beneficial Cargo Owner (BCO) contracts are being signed at 30-45% lower than expiring indexed contracts—possibly in anticipation of a Red Sea/Suez reopening.

- Reliability: Still inconsistent due to varying Panama and Cape of Good Hope transit times.

South Asia to Europe

- Rates: Spot rates have declined by about 30% since the start of the year. Contract rates are now lower than January 1 levels but still 6% higher than in May 2024. Currently, contract rates are almost 15% lower than spot rates.

To U.S. / North America

TPEB: Asia to U.S. East & Gulf Coasts

- Supply & Demand: Demand is still weakening; supply is very available, though April GRIs temporarily pushed spot rates higher.

- Rates: Spot/short-term rates have dropped about 45% since January 1. Spots are 15% higher than contract rates. Early reports indicate that large shipper contracts being negotiated now are 30-45% lower than expiring indexed contract averages, possibly in anticipation of a Red Sea/Suez reopening.

- Reliability: Still unreliable, with a mix of Panama and Cape of Good Hope routings leading to significant transit variations.

TPEB: Asia to U.S. West Coast

- Supply & Demand: Demand is slowing, and capacity is strong.

- Rates: Short-term spot rates rose about 16% in April due to GRIs but may drop quickly as the market softens. Rates fell more than 50% from January 1 through March. May 2024 contract rates were 10% lower than March-end contracts.

- Reliability: Improved and much better than the East Coast.

SAUS: South Asia to U.S.

- USEC and USWC: Spot rates have dropped 35% for USEC and over 40% for USWC since January. Contract rates are about 40% lower than spots for USEC but only 15% lower for USWC.

- Contracts: May 2024 contract rates were 15% higher to USEC than now, while they were 13% lower than current USWC contracts.

- Note: Across the Transpacific, carriers may implement more blank sailings to align capacity with demand and stabilize or raise spot rates.

TAWB: Trans-Atlantic Westbound

- Supply: Good capacity at most origins, with fewer blank sailings. New services from alliance realignments should help stabilize the market.

- Rates: General Rate Increases (GRIs) are being reduced. Spot rates are down 20% since early 2025 but unchanged from March 1. Current contract rates are 20% lower than spot rates and nearly 15% lower than May 2024 contracts.

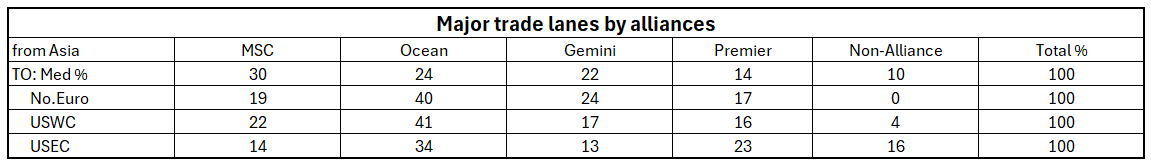

New Carrier Alliances (With Estimated TEU Capacity)

- MSC – Independent of alliances but with some strategic partnerships (20%)

- The Gemini Cooperation (Maersk & Hapag-Lloyd) (24%)

- The Premier Alliance (HMM, ONE, and Yang Ming) (13%)

- The Ocean Alliance (CMA-CGM, COSCO, OOCL & Evergreen) – No changes (26%)

- Wan Hai & Zim operate outside alliances with some partnerships (5%)

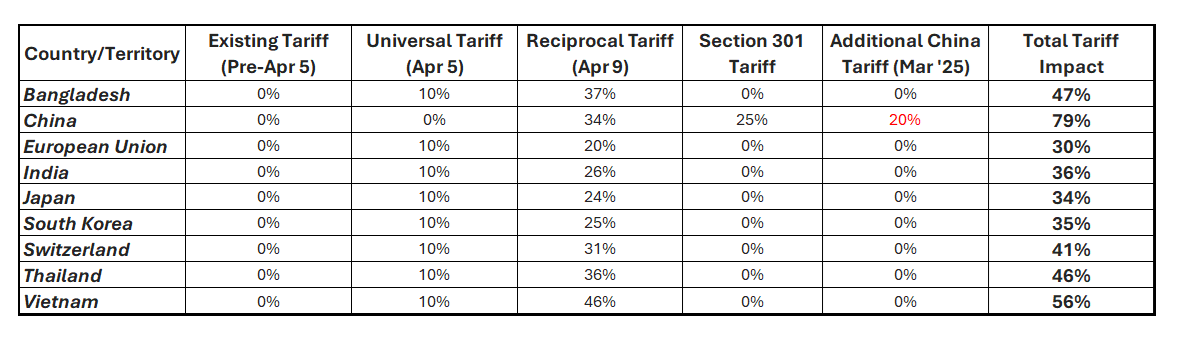

Update on New Tariff Implications

Just Announced: U.S. Reciprocal Tariffs Added to Existing Tariffs

Impact of Trump's Tariff Plans

- Maersk expects continued U.S. growth despite tariff uncertainty.

- Ongoing U.S. tariffs could disrupt global trade flows and slow supply chain momentum.

- Businesses are accelerating imports and securing storage space to mitigate disruptions.

Key Concerns

- Declining U.S. consumer confidence (four consecutive months of decline).

- Shifts in inventory strategies (accelerating imports and securing storage space).

- Potential disruption to international trade flows.

Example of new US tariffs:

New U.S. Tariffs

- Additional tariffs imposed on top of existing tariffs (Section 301, Section 201).

- Products already subject to duties face new reciprocal tariffs unless exempted.

Exempted Goods Include:

- Certain U.S.-protected articles.

- Steel/aluminum under Section 232.

- Autos/automotive parts under Section 232.

- Copper, pharmaceuticals, semiconductors, lumber, critical minerals, and energy products.

Wrap-Up

Due to these new tariffs, there are ways to offset some of these additional costs. Consider revising Incoterms and adjusting seller/buyer relationships and responsibilities. Other tools include leveraging Foreign Trade Zones (FTZ), First Sale options, setting up trading companies, and reviewing Free Trade Agreement (FTA) benefits and current classifications.

Navigating these changes requires expert guidance. Do you have a trusted logistics and trade partner to help you manage compliance, optimize costs, and streamline operations? WOWL provides the expertise and support you need to stay ahead in this evolving trade landscape. Contact us today to ensure your business is prepared.