The ocean freight market is experiencing rapid changes. Carrier operations are at peak capacity, with minimal vessel downtime. Vessel scrapping is at an all-time low, while new vessel orders are hitting record highs. The coming months may bring a "perfect storm" of events. Here’s an overview of critical developments:

- Rates from Asia to Europe and Mediterranean ports remain high after consistent increases over the past three months.

- Despite initial fears of a shipping surge from Asia, rates to North America have begun rising by over 10%.

- The approach of Lunar New Year (January 29) is driving a shipping rush, particularly from China.

- U.S. East Coast labor contracts are set to expire on January 15, posing a strike risk.

- New tariff threats on China-to-U.S. shipments could take effect on or after January 20.

- Red Sea and Suez Canal disruptions continue to force vessels to reroute around Africa, impacting transit times and capacity.

Regional Insights

Asia to Northern Europe

- Demand: Remains strong, with congestion reported at Northern European ports.

- Spot Rates: Up nearly 50% in the last two months, with contract rates for 2025 settling 30% higher than 2024 levels.

Asia to the Mediterranean

- Spot rates have surged by approximately 60% over the past two months.

- 2025 contract rates are showing significant increases compared to 2024 agreements.

Asia to U.S. / North America

Expecting an increase in blank sailings in early January. Contract issues for the U.S. East Coast (see below) present a high risk.

East & Gulf Coasts

- Spot rates are climbing, up 8% in recent weeks after a stagnant period since early October.

- With the high likelihood of a longshoremen strike at U.S. East and Gulf Coast ports, shipping volumes out of China and South Korea are increasing.

- Shipments not already en route are unlikely to arrive before labor contracts expire on January 15.

- Alternate routings to the West Coast or other options will likely encounter congestion and delays.

West Coast

- Spot rates have risen 10–12% in the short term.

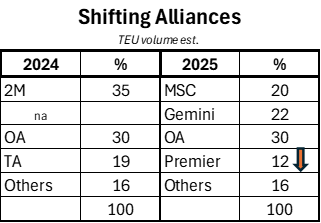

Carrier Alliance Updates

- Major changes to alliance structures and service strings are ongoing and will continue through Q1 2025.

- Operational disruptions are expected across most alliances, with the exception of the Ocean Alliance.

- Premier Alliance has postponed some planned service string changes until later in the first half of 2025.

Table of past and current ocean alliances:

Market Dynamics

Oversupply in Ocean Freight

- Oversupply is projected to grow from 3–4% in 2024 to 7–8% in 2025.

- According to Dynamar analyst Darron Wadey, approximately 220 vessels are scheduled for delivery in 2025, adding about 1.9 million TEU to global capacity. A growth rate of 3%, and a capacity increase of 6% if there is no scrapping.

New Container Builds

- Dry container construction for 2024 is approaching 7.3 million TEU, reflecting a 6.5% growth rate.

- This level of production is expected to mitigate the risk of global equipment shortages.

Final Thoughts

These updates highlight some of the critical issues shaping the ocean freight market as we approach 2025. The first quarter promises to be dynamic, with potential challenges stemming from labor disputes, tariff changes, and alliance restructuring.

Navigating these complexities requires not just awareness but also the right tools and expertise. That’s where WOWL comes in. Our innovative platform streamlines global supply chain operations by providing real-time insights, integrating disparate data, and enabling seamless communication among partners. Whether you need to monitor shifting rates, assess alliance changes, or adapt to unexpected disruptions, WOWL is your trusted partner in optimizing performance and minimizing risk.

Stay engaged with your providers and leverage WOWL’s cutting-edge solutions to turn challenges into opportunities. Together, we’ll help you build a more agile, efficient, and future-ready supply chain.

Follow WOWL for continued updates and alerts to help you navigate this turbulent market effectively.